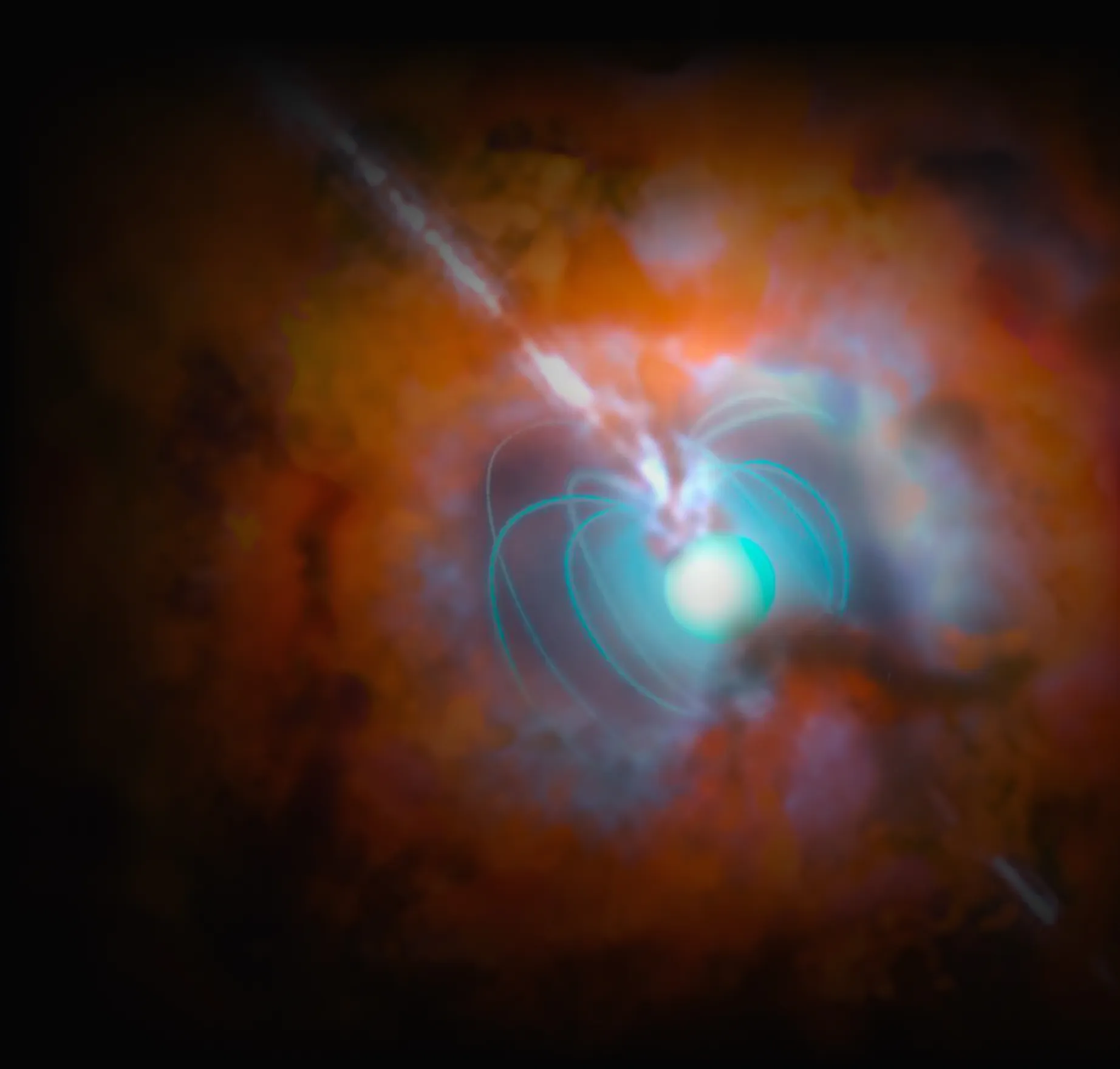

Hypernova Fund

Where Capital Meets the Cosmos

Key Investment Themes

Hypernova is backing companies defining

the future

of space

Energy Generation

X-energy, Zeno Energy, StarCatcher (powering space missions)

Space Debris Management

Orbital cleanup solutions

Space Infrastructure

Orbital stations, logistics, and long-term mission support

Propulsion Systems

Advanced engines for satellites and deep space travel

Space Weather Monitoring

Predicting solar activity to safeguard assets and crewed missions

Invested

Team

Proven operators, managers and leaders. Access to exclusive deals, deep industry expertise, and a global network

Grigorii Trubkin

MP, MIT New Space Economy,

second-term MP

Mary Glaz

Venture Partner

Mary Glaz

Venture Partner

Aerospace engineer & commercial pilot, CEO, Mission Space

Steve Wolfe

Advisor

Steve Wolfe

Advisor

President and Co-Founder of the Beyond Earth Institute. Deputy Executive Director of the Global Spaceport Alliance and Partner at CWSP International. Former senior staff member to Congressman George E. Brown, Jr., where he served as Executive Director of the Congressional Space Caucus and drafted the Space Settlement Act of 1988, later enacted within the NASA Authorization Act. Board member of the Global Entrepreneurship Network – Space and the Journal of Space Philosophy. Author of The Obligation: A Journey to Discover Human Purpose on Earth and in the Cosmos.

Captain Stephan Reckie

Advisor

Captain Stephan Reckie

Advisor

Executive Director at GEN Space and Co-Founder of Angelus Funding. USCG Master Captain, educator and mentor. Board Member at New Venture Lab and Adjunct Professor at Gonzaga University.

Justin Kugler

Advisor

Justin Kugler

Advisor

Senior Director of Business Development at Intuitive Machines, where he leads the company’s growth as a next-generation prime contractor across its three core business verticals: building advanced spacecraft and lunar systems, connecting space assets through communications and data networks, and operating missions that support long-term activity from LEO to the Moon and beyond. He drives strategy and new business creation in areas such as space industrialization, space infrastructure services, and Earth-return capabilities for the civil, commercial, and national security sectors.

He holds engineering degrees from Texas A&M and Rice, along with a strategic foresight certification from the University of Houston. His career spans intelligence service at the CIA, human spaceflight modeling and simulation, microgravity payload management, standing up the ISS National Laboratory, and executive leadership roles in space-based manufacturing at Made In Space and Redwire. Justin brings this mix of technical depth and strategic experience to shaping Intuitive Machines’ future offerings and expanding its role in America’s space enterprise.

Why space. Why now

Public & Private Capital

Increasing institutional

and venture investment

Commercial Expansion

Growth in satellite data, space logistics, and resource extraction

Cost Reductions

Cheaper launches and hardware manufacturing

Government contracts ensure stable funding (NASA, ESA, DoD)

Space remains resilient despite market fluctuations

WEF projects $1.8T space economy by 2035 (from $630B in 2023)

Investment Focus & Selection Criteria

Infrastructure & Core Tech

Propulsion, satellite platforms, in-orbit services

Early-Stage Companies

Seed to Series A, ready for scaling

Strategic Contracts

Secured government or enterprise deals

Experienced Teams

Aerospace and deep-tech expertise

Why Hypernova?

Fund focused

on high-growth

, private space companies. Investing in strategic projects backed by government contracts and private funding. Access to

exclusive deals,

deep industry expertise, and a global network

Exclusive Access

Curated pipeline of vetted companies.

Global Network

Partnerships with Axiom, Voyager, Quantum, and top accelerators

Transparent Structure

Clear investment terms and exit mechanisms

Risk Management

Diversified portfolio

across 15–20 companies

Industry Expertise

Deep understanding of space tech and startup scaling

Be part of a fund investing in the next SpaceX-level success stories. Back high-growth companies shaping the trillion- dollar space economy